What Happens to the Farm Once You're Gone?

January 5, 2026

Author name

You love your farm but what happens when you decide to retire or you pass away? Which simply raises the question:

“Once you’re gone, what happens to your farm?”

The fact that you are here, reading, might mean you’ve asked yourself the same question, so in order to make the answer a little easier, we are going to have a look at how you can create a proper succession plan.

The Imbalance of Inheritance

Before we get to the practical side of succession planning, an explanation on the best mindset to have when approaching this delicate subject becomes necessary.

In what so many call “the good ol’ days”, a common theme for succession was that when a landowner died his property would pass on to the closest male relative of the family, inevitably excluding women from any land inheritance.

So, what exactly happened, for example, if the landowner had left a brother, a wife, and daughter?

The ownership of the estate would pass on to the brother, and the deceased’s wife and daughter would be left to fend for themselves, which created a problem. One that we are unfortunately still seeing some of the side effects to this day.

Our friends at CWA

realised this problem some time ago and created accommodation for some of these displaced women. But that isn’t a long term solution and probably not one you want for your loved ones.

There are still many family businesses that haven’t addressed this issue and hopefully this article jogs you to acknowledge and take action on planning for a future that you may or may not be part of but are most likely to be able to influence.

The Danger of An Unfairly Written Will

As you can imagine, the practice adopted in the “the good ol’ days” led to a great deal of injustice, after all, farms are more than just land, they are also businesses, and having only the closest male relative inherit all the farm assets often created an uneven distribution of the deceased assets between the men and women in the family.

One of the ways in which society has addressed this inequity was to introduce the Family Provision Act 1972 (FPA), which gave women (and other family members generally), a right to contest an unequal distribution where they felt that they were treated unfairly by their deceased parent (or partner or grandparent).

However, the relevant test under the FPA does not hinge on someone’s subjective view of what is fair or unfair. The test is whether the deceased made “adequate provision from his/her estate for the proper maintenance, support, education or advancement in life” of the person contesting the distribution. As you will no doubt suspect, the meaning and interpretation of this phrase has itself led to many disputes.

The obvious danger is that the test is not necessarily straight forward and lends itself to further dispute and legal complication.

That is to say: A failed Succession Plan can easily lead to the destruction of family ties where siblings sue each other for property and fight over the property left by their parents or partner.

Before You’re Gone

In order to address the potential inequities and legal complications that can arise from not having a succession plan, or not having a properly balanced succession plan, it is important to recognise that the “farm” is not just a square of land, but is also a business, with all the different assets and complications that that come with running a business.

Farm businesses are often set up with different entities separately owning the land, the machinery and stock, and also quite often a completely separate entity operates the “business”.

So, to provide balance and to try to avoid possible conflicts that may arise with your departure, a common and efficient solution is to deal with your assets whilst you are still alive.

There are some advantages to this, one being that as you are still around, you can act as a mediator between your spouse and or children, and you have the ability to talk to them to try and manage expectations over wants and needs, before you depart.

In preparing any succession plan it is important to remember that everyone is different and will not necessarily have the same expectations on inheritance. This highlights a benefit of being able to discuss your proposed succession plan with your children whilst you still can. This can assist in structuring the distribution of your assets among your children.

Shared Ownership and Inheritance

Here’s another pickle for you:

Let’s say there are three brothers that inherited a farm together and have been working it for thirty-five years, now one of them is looking to retire and pass down his share to his descendants.

How can the farms assets be correctly passed down the succession line without creating complete chaos?

There may be a multitude of ways to achieve this, each dependent on the current structures of ownership and control of the farms, the business and assets and other imposts, such as taxation and duty costs. Attempting to find a low cost way to achieve the desired outcome can sometimes be a complex problem and solutions may require some expense and some time to implement.

Where trusts are involved, complications can arise due to the breadth of the pool of beneficiaries, who the appointors and guardians are, who controls the trustee if it is a company and tax and duty implications if property is to be moved out of the trust to another entity.

These issues are a reminder that when setting up the farm and its business, to do so with one eye to the future and the possibility that one or more of the business founders will pass on whilst the business is operating. On this, it is important to remember that for a partnership, where there is no written partnership agreement dealing with the situation, the death of a partner forces the partnership to end. This may also result in the partnership bank accounts being frozen.

Conclusion

If you are going to come out of this article with one takeaway, then let it be this: The best way to ensure the orderly and peaceful succession of your assets after your retirement or death is to look and plan ahead.

This is not the type of thing that you leave to the last minute, and it pays to build your agricultural business with its inheritor in mind, especially when you are not the sole proprietor.

I realise that the topic is large, but that’s because its complexity makes it hard to unravel all the minutia that comes with it.

So, if you have questions, or simply would like to learn more on the subject, I’ll be doing seminars

on the subject of succession planning throughout the lower South West from May 27th through to the end of July.

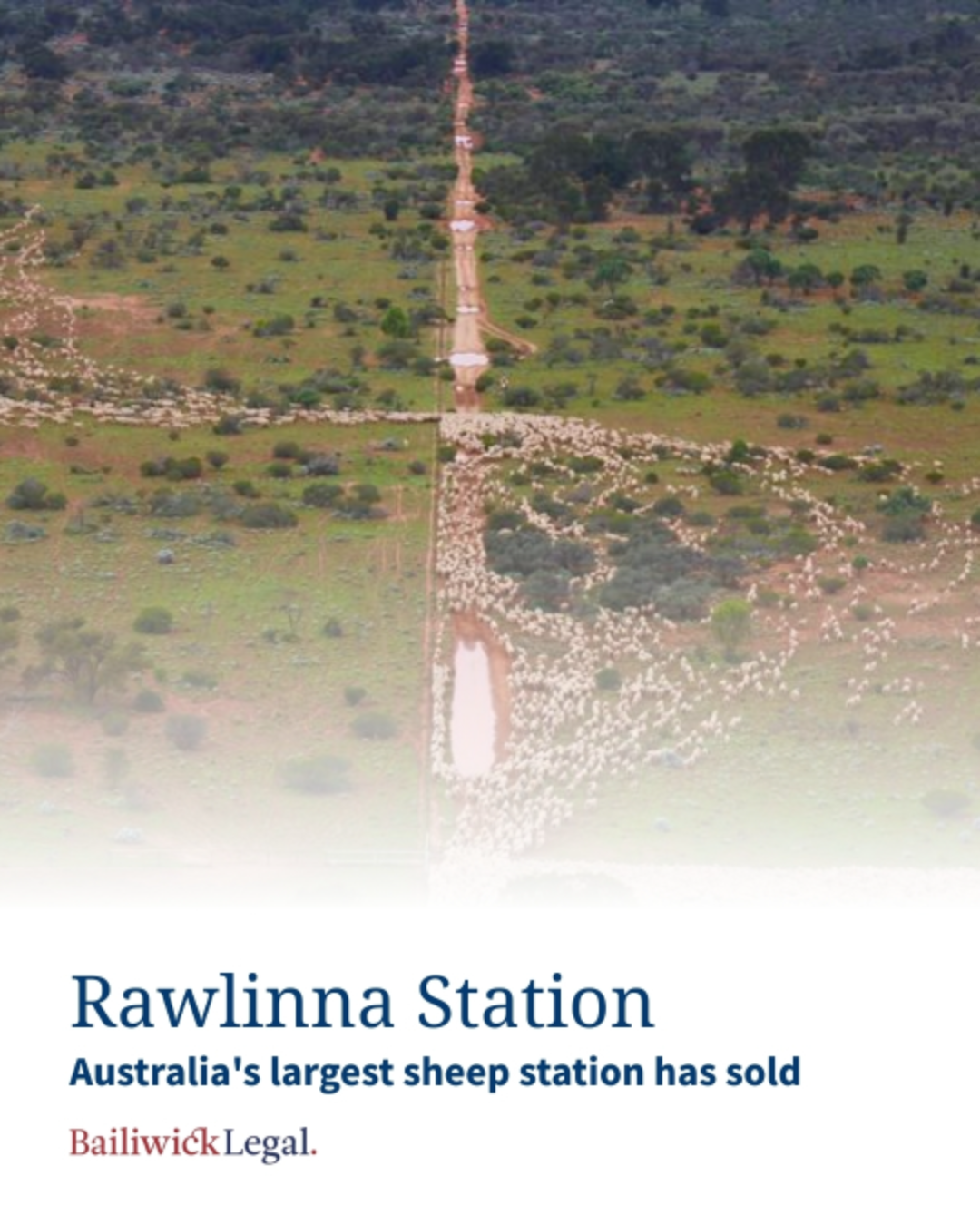

Bailiwick Legal Advises on Landmark Acquisition of Rawlinna Station by Consolidated Pastoral Company

Bailiwick Legal is proud to have acted for Consolidated Pastoral Company (CPC) in its successful acquisition of Rawlinna Station , Australia’s largest sheep station, located on the remote Nullarbor Plain in Western Australia. Spanning over 1 million hectares and running approximately 30,000 sheep , Rawlinna is an iconic pastoral asset with a rich legacy, having been held by the MacLachlan family’s Jumbuck Pastoral Company since its establishment in 1962. The sale marks the first change of ownership in over six decades and was finalised following formal approval from the Western Australian Government for the transfer of the pastoral leases. This transaction involved navigating: The transfer of three separate pastoral leases Coordination across multiple vendor entities Consideration of livestock and operating assets Fulfilment of regulatory and compliance requirements, including WA lease approval processes Bailiwick Legal is a boutique agricultural and regional law firm , proudly based in Perth and Bridgetown, Western Australia. Our role in this acquisition demonstrates that deep sector knowledge, local insight, and personalised legal support are crucial for agribusiness clients managing complex, high-value transactions. Our team, led by our regionally-based solicitor, Matilda Lloyd, provided end-to-end legal and strategic support, including: Due diligence on land tenure and operating assets Contract negotiation and preparation Advice on regulatory approvals and compliance Strategic coordination with CPC’s internal and external stakeholders to ensure a smooth and timely settlement We are honoured to have supported CPC in this milestone acquisition and look forward to watching Rawlinna’s next chapter unfolds. At Bailiwick Legal, we believe that regional expertise, deep industry knowledge, and relationship-based service remain essential to agribusiness success, no matter the scale. Congratulations to all parties involved, including the MacLachlan family, whose stewardship of Rawlinna leaves a lasting legacy in Australian agriculture. – The Bailiwick Legal Team Working alongside agribusinesses to grow, transition, and thrive . For assistance with all of your agribusiness needs, contact Bailiwick Legal on 08 9321 5451 or email office@bailiwicklegal.com.au By Matilda Lloyd (Associate) For further information about our legal services, please visit our website: https://www.bailiwicklegal.com.au The above information is a summary and overview of the matters discussed. This publication does not constitute legal advice and you should seek legal or other professional advice before acting or relying on any of the content.

The International Sustainability and Carbon Certification (ISCC) System has come to the attention of many Western Australian farmers recently, as the scheme has changed one of its policies regarding aerial spraying. What is the ISCC? The ISCC is one of the world’s largest voluntary sustainability certification schemes enabling participants to demonstrate they are producing materials in a sustainable way that meets or exceeds community expectations. In Australia it is widely used in the canola industry, enabling Australian canola growers to access the European biofuel market. CBH Marketing and Trading holds certification for the ISCC EU and ISCC PLUS programs, that cover canola, barley, oats, wheat and lupin, allowing WA growers to participate in both programs. Participating in the ISCC program can result in a premium on grain, however participants are subject to more stringent measures to satisfy sustainability accreditation requirements. Recent decision on aerial spraying ISCC Principle 2.6.2 prevents aerial spraying from taking place within 500 metres of a body of water. CBH has successfully lobbied for an exemption to this Principle, for farm dams and salt lakes of low ecological value. As part of its lobbying, CBH provided expert reports to the ISCC on the hydrology and ecology of WA farm systems. For farmers who are signed up to the ISCC program, this removes an obstacle during the season for weed management. The Principle does still require a 500 metre buffer for other bodies of water, including freshwater lakes, rivers, ponds or creeks. However, for those who farm yabbies and marron, this change may not be welcome. Marron and yabby farmers have noticed impacts on their populations where aerial spraying has taken place close to their properties, and aerial spraying can unintentionally damage natural vegetation, including young and old growth trees. For growers, it’s always prudent to follow best practice guidelines for aerial spraying to avoid spray drift – including monitoring weather conditions and the effect of water added to the chemical. For some farmers, this decision may prompt an examination of whether signing up to the ISCC program might be best for their business. In this circumstance, it is important to weigh up the potential benefits of the program compared to the sustainability accreditation requirements. For others, this decision is a timely reminder to stay up to date with best practice guidelines when it comes to spraying, particularly during the seeding season. For assistance with all of your agribusiness needs, contact Bailiwick Legal on 08 9321 5451 or email office@bailiwicklegal.com.au By Ciara Nalty (Solicitor) For further information about our legal services, please visit our website: https://www.bailiwicklegal.com.au The above information is a summary and overview of the matters discussed. This publication does not constitute legal advice and you should seek legal or other professional advice before acting or relying on any of the content.